Bank of Japan officials see a good chance of raising interest rates next week, as long as Donald Trump’s arrival at the White House doesn’t trigger too many negative surprises, according to people familiar with the matter.

BOJ officials acknowledge the likelihood of raising the rate from 0.25% at the end of its two-day meeting on Jan. 24, unless Trump ruffles markets or changes expectations about the global economy at the start of his presidency, the people said.

The central bank will make a final policy decision after reviewing economic data, markets, and the implications of U.S. economic policies up until the last minute, the people said.

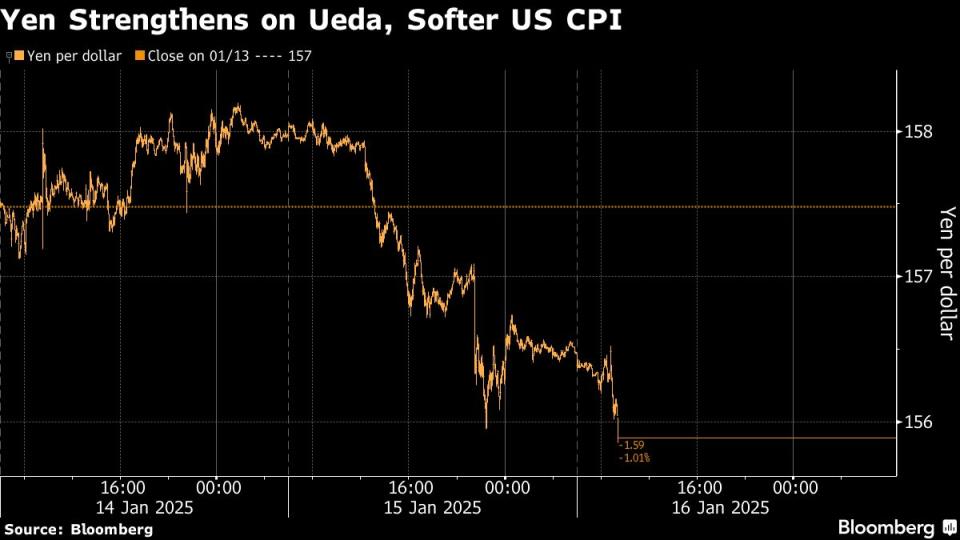

The officials’ views largely align with elevated market expectations for a rate increase this month after Governor Kazuo Ueda and one of his deputies, Ryozo Himino, said this week they would decide if a hike is warranted at the January gathering. The yen has climbed for two consecutive days against the dollar to its strongest level in a month.

“Ducks are lining up for a BOJ hike next week, and the mood music from officials is becoming more assertive,” said Rodrigo Catril, a currency strategist at National Australia Bank in Sydney. “Of course, Trump tariffs could spoil the party, but Japan is not Trump’s main focus of attention.”

Economic Outlook

The officials see Japan’s economy and inflation continuing to align closely with their projections, which boosts their confidence that the bank’s economic outlook will support its stable 2% inflation target, according to the people.

Ueda has repeatedly stated that the bank will adjust its monetary easing if prices and the economy follow the BOJ’s economic outlook.

Officials anticipate upgrading the BOJ’s forecasts for inflation excluding fresh food and energy for both this fiscal year and next, which would support a rate increase at the meeting, according to the people.

Since the last meeting in December, officials have also grown more confident about wage increases, especially after a BOJ branch managers’ meeting earlier this month. Annual spring wage negotiations are expected to yield a solid result similar to last year’s, with Japanese firms increasingly viewing wage hikes as a given, the people said.

Momentum in wage growth is one of two key factors Ueda says requires close attention when deciding the timing of borrowing cost hikes, along with the outlook for the U.S. economy. While BOJ officials hope Trump’s second administration will launch smoothly, they remain vigilant for any potential risks, the people said.