The most recent data might bolster policymakers’ confidence that inflation is gradually aligning with the Federal Reserve’s objectives.

Just ahead of the Federal Reserve’s latest rate decision, fresh inflation figures revealed a notable slowdown in price increases during May.

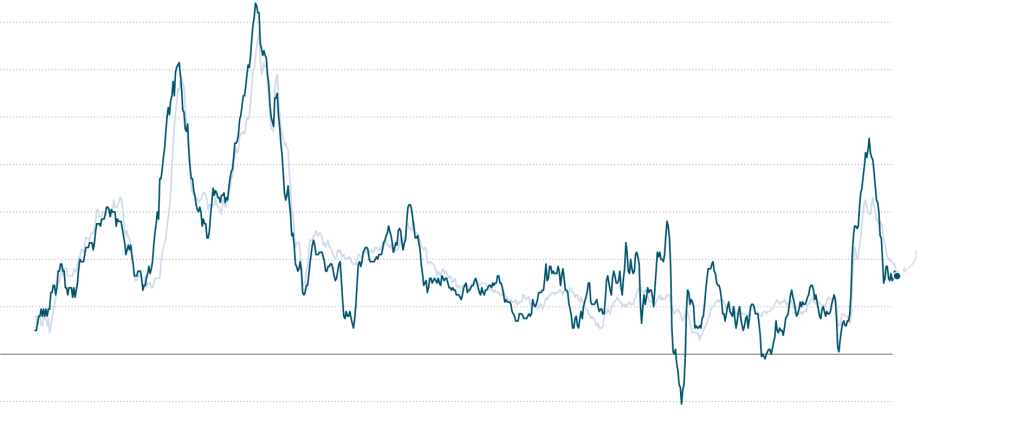

This recent report indicates a cooling trend in inflation after a period of stubbornness earlier in 2024, potentially guiding Fed officials in charting the course for future interest rates. Following a robust slowdown in price hikes in 2023, policymakers adopted a more cautious stance when inflation progress stalled earlier this year. The latest data could bolster their confidence in inflation gradually returning to the central bank’s desired level.

Key points to note:

- Overall inflation moderated: The Consumer Price Index for May rose by 3.3 percent compared to a year earlier, below the 3.4 percent economists had predicted and a decline from the April figures. Furthermore, when compared to the previous month, May prices remained unchanged.

- Core inflation also decelerated: A significant metric that excludes volatile food and fuel prices, providing insights into the underlying trend, increased by 3.4 percent from a year earlier, down from 3.6 percent in the previous month and below economists’ expectations. This marks the slowest pace of increase since April 2021.

- Implications for the Fed: With central bankers set to announce their rate decision, while it’s widely anticipated they will maintain interest rates this month, the fresh inflation data could influence their projections for the remainder of the year. Policymakers will release their initial economic forecasts since March alongside their policy statement. This report could lay the groundwork for potential interest rate adjustments sooner than expected.

- Insights from economists: While acknowledging the positive trend, economists caution that it’s based on a single month’s data. Michael Feroli, chief U.S. economist at J.P. Morgan, suggests the Fed is unlikely to make immediate rate cuts solely based on this report but sees a case for a September adjustment following today’s findings.

- Contextualizing inflation: While the current inflation rate exceeds pre-pandemic norms, it’s a marked decline from the peak of 9.1 percent in 2022. The Fed targets a 2 percent inflation rate, although it utilizes the Personal Consumption Expenditures index for measurement, with data from the CPI release contributing to this report.

- Contributing factors to the cooling trend: Unexpected slowdowns in car insurance price hikes and decreased costs for hotel and flight bookings were observed last month. While rent inflation remains persistent, forecasts suggest it may ease in the near future. Apparel prices saw a monthly decline, and grocery inflation remained moderate.

- Positive implications for consumers and the White House: With summer vacations becoming more affordable and shopping expenses easing, consumers stand to benefit. Coupled with recent labor market improvements, the reduction in inflation could positively impact families’ financial well-being. The White House may find solace in these developments as cooling inflation coincides with a robust job market and solid wage gains, potentially bolstering public sentiment ahead of the 2024 election. President Biden welcomed the progress but acknowledged that prices still need to come down further.