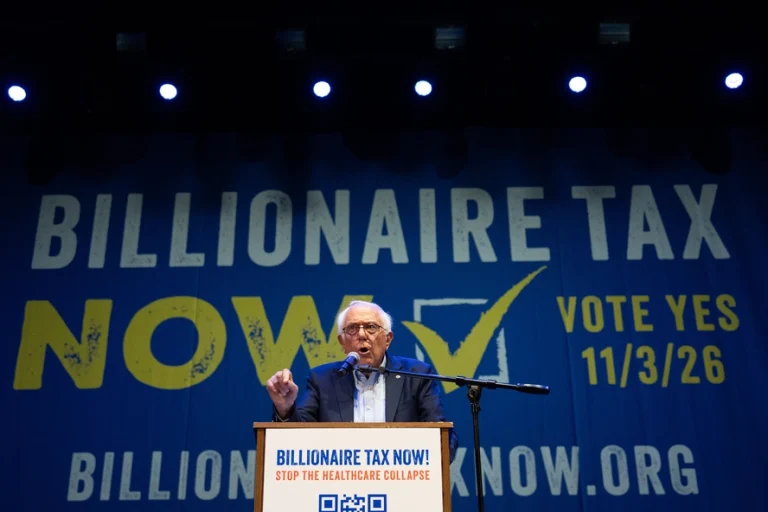

Bernie Sanders Rallies Support for California Wealth Tax: ‘Enough Is Enough’

Senator Bernie Sanders visited Los Angeles this week to energize support for a proposed wealth tax on the state’s richest residents. Speaking to a large crowd of activists, union members, and concerned citizens, Sanders described the current economic system as “rigged” in favor of billionaires, and he called for a one-time 5% tax on individuals with a net worth exceeding $1 billion. His message resonated with many who feel the gap between the ultra-wealthy and everyday Californians has grown unacceptably large.

Sanders declared, “Enough is enough,” emphasizing that wealth should not be concentrated in the hands of a few while public services struggle. He framed the proposed tax as a moral and practical necessity, capable of generating tens of billions of dollars to support critical programs like healthcare, education, and social welfare. Attendees repeatedly cheered and waved signs urging bold action on inequality.

The senator’s appearance is part of a broader grassroots campaign to collect the nearly 900,000 valid signatures required to qualify the California Billionaire Tax Act for the November ballot. Supporters are racing against a spring deadline, mobilizing volunteers across cities and communities to maximize outreach. Sanders’ presence underscores the political weight the initiative has gained and highlights the rising profile of wealth redistribution debates in California.

What the Proposed Wealth Tax Entails

The California Billionaire Tax Act aims to levy a one-time 5% tax on individuals whose net worth exceeds $1 billion, including assets such as stock, business holdings, real estate, and intellectual property. Advocates argue that such a tax could generate roughly $100 billion, funds that would help offset federal funding cuts and bolster public services that are increasingly under strain.

Union leaders, particularly those representing healthcare and public service workers, have voiced strong support for the initiative. They argue that federal cuts to Medicaid and other programs have created a crisis in hospitals and schools, and that new revenue from billionaires is critical to maintaining services that serve millions of Californians.

Sanders emphasized that the tax is not just about money—it is a statement against extreme inequality. He warned that the unchecked accumulation of wealth by a tiny fraction of the population undermines democracy and makes it harder for ordinary citizens to succeed. Supporters see the tax as a symbolic and practical step toward fairness in the economic system.

Political Resistance and Criticism

Despite strong grassroots support, the initiative faces opposition from some prominent Democrats, including Governor Gavin Newsom. The governor has expressed concern that the tax could prompt wealthy individuals and businesses to leave California, potentially weakening the state economy and reducing long-term investment. Critics also argue that such a tax could have unintended consequences for innovation and entrepreneurship, particularly in Silicon Valley.

Business leaders and tech entrepreneurs have voiced similar concerns. Some have threatened to relocate their assets or residency to states with lower tax burdens if the initiative moves forward. These warnings have fueled debates about balancing fair taxation with economic competitiveness.

Republican lawmakers at both state and federal levels have also seized on the controversy, suggesting legislative measures to protect residents from retroactive or excessive state taxation. The debates underscore the complex interplay between tax policy, politics, and economic incentives in high-cost states like California.

The controversy has drawn national attention, with analysts noting that California often sets precedents that other states follow. How the public and policymakers respond to the wealth tax could influence future initiatives across the country.

Public Engagement and Grassroots Mobilization

Supporters of the tax are actively mobilizing across California, canvassing neighborhoods, hosting town halls, and educating voters about the initiative’s potential benefits. Volunteers emphasize that the funds could provide more teachers, improve healthcare access, and stabilize social programs that have been underfunded for years.

Community organizations are playing a key role in this outreach. From labor unions to social justice groups, the effort highlights a coalition-based approach to policy advocacy, demonstrating the power of coordinated grassroots campaigns in shaping public discourse.

Public opinion polls indicate strong support among younger voters and progressive constituencies, although opposition remains pronounced among high-income earners and business communities. How these perspectives balance out at the ballot box will determine whether the initiative moves forward.

Potential Impact on California’s Economy

If implemented, the wealth tax could generate billions in one-time revenue to address funding gaps in education, healthcare, and infrastructure. Proponents argue that the tax would have a minimal effect on California’s broader economy while delivering significant social benefits.

Opponents, however, warn of possible long-term repercussions, such as diminished investment and relocation of high-net-worth individuals. Economists debate the potential effects, with some suggesting the impact on jobs and innovation may be limited if carefully structured and applied as a one-time measure rather than a recurring levy.

The debate also reflects broader concerns about wealth inequality in the United States. California, home to many of the nation’s billionaires, is often at the forefront of experiments in taxation and economic policy. The outcome of this initiative could influence national discussions on fair taxation and corporate responsibility.

Next Steps for the Initiative

The immediate challenge for supporters is collecting enough signatures to qualify the measure for the ballot. Once approved, the campaign will shift toward voter education, fundraising, and messaging to counter criticisms. Legal challenges are also likely, particularly over retroactive provisions and the definition of taxable assets.

Regardless of the ultimate outcome, Sanders’ involvement has amplified awareness of wealth inequality in California and underscored the growing public appetite for bold solutions. The senator’s rallying cry—“Enough is enough”—has become a touchstone for advocates seeking structural reforms to address systemic economic disparities.

The weeks and months ahead will reveal whether the initiative can maintain momentum amid political opposition and legal scrutiny. Both sides are preparing for an intense campaign season leading up to the November election, with the future of California’s wealth tax debate hanging in the balance.