[ad_1]

I’ve a Solo 401(okay) at Vanguard for a few years and it has served me effectively.

The small enterprise portal, once you handle the account from the employer facet, appears a bit dated however capabilities simply high quality. I’m capable of shortly make a contribution as soon as a month (I’d have liked a strategy to automate it however alas that was to not be) and it recorded every transaction so I may simply “repeat” them.

It seems that Vanguard has offered the Particular person 401(okay), A number of Participant SEP (Multi-SEP), and SIMPLE IRA Plans enterprise to Ascensus, per their press launch.

On Monday, I obtained a letter notifying me of the modifications. I hadn’t even heard about it till getting the letter yesterday.

Personally, I discover this a little bit annoying.

Like many individuals, I don’t like change, particularly when it occurs to one thing that’s working comparatively effectively.

However after digging in additional, it’s not going to be a important change (however it’s nonetheless a little bit annoying).

Desk of Contents

The Discover

Listed below are the three pages of the discover (click on on them to develop right into a a lot bigger dimension):

Just a few typical legalese in addition to what to anticipate within the transfer. The one important factor to notice is that there’s a blackout interval from July seventeenth by way of the week of July twenty second, so doubtlessly till July twenty sixth. That’s a doubtlessly two week interval, which is a very long time.

Who’s Ascensus?

Ascensus is a monetary companies firm that was based in 1980 and headquartered in Dresher, PA. Vanguard is headquartered in Malvern, PA and the 2 corporations are solely 26.2 miles aside. The 2 aren’t affiliated in any means but it surely’s fascinating that they’re situated so carefully to 1 one other. Ascensus itself is owned by Stone Level Capital and GIC, Singapore’s sovereign wealth fund.

Ascensus manages numerous retirement plans, together with these of many states similar to California’s program CalSavers.

With out seeing what goes on behind the scenes, I’d anticipate it to supply comparable companies to what Vanguard presents and I’d be as comfy utilizing Ascensus as I might Vanguard.

Which Accounts Are Being Offered?

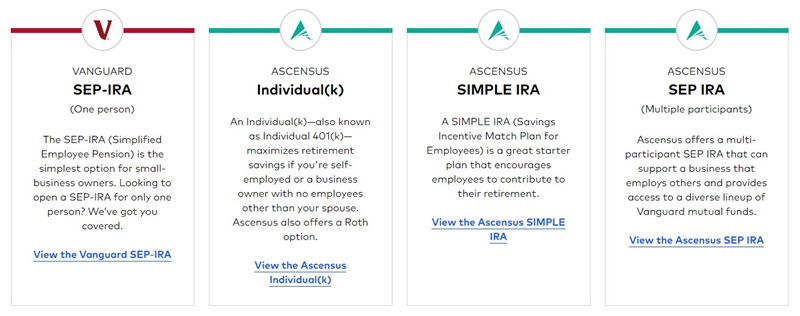

You probably have an Particular person 401(okay), a SIMPLE IRA, or a SEP IRA, these are all shifting over to Ascensus. The Vanguard web site is already up to date with the modifications.

You probably have an SEP-IRA, that’s remaining at Vanguard. All the pieces else is shifting.

I’ve an Particular person 401(okay) so it was included within the transfer.

What Will Change?

Legally, what is going on is that Vanguard Fiduciary Belief Firm is transferring sponsorship to Ascensus Belief Firm. Then Vanguard Fiduciary Belief Firm is resigning because the Trustee, efficient July twenty second. If I wish to transfer my 401(okay), I’ve to do by July twelfth in any other case I’ve to attend till the switch is full.

At first look, the most important change would be the payment construction.

For the account payment, Ascensus prices a $20 annual payment per participant. Vanguard charged $25 however would waive it in case you had $5 million in belongings or in case you signed up for e-delivery of statements. It’s unclear if Ascensus presents this waiver choice for e-delivery.

Subsequent, Ascensus prices an annual account service payment of $20 per mutual fund for particular person 401(okay)s. Vanguard prices comparable charges but it surely was waived if somebody within the plan had at the least $50,000 in belongings.

My 401(okay) plan charged $20 for every Vanguard mutual fund in every account however was waived. For those who had a SIMPLE IRA, you really get a small low cost as a result of Vanguard would cost you $25 per fund per account (in case you didn’t have it waived). Ascensus solely prices $20.

We preserve our 401(okay) holdings in only a handful of funds so this has a restricted influence on us ($100 – $160 throughout two accounts) a 12 months whole throughout two contributors. But it surely’s nonetheless annoying to must pay a brand new payment out of the blue, although it’s a comparatively small one.

What Will We Do?

For now, I’m going to depart the account with Ascensus.

Because it seems, it’s not trivial to maneuver a 401(okay) as an employer. There’s numerous articles about rolling over a 401(okay) as an worker, and as somebody who has completed it a number of occasions it’s fairly straightforward, however shifting the entire plan is a little more concerned and it’s not clear what benefits there are to shifting it.

The clearest benefit is that I may keep away from the brand new charges. Constancy has a self-employed 401(okay) that has no account charges and no minimums. I’d anticipate it to look and behave simply the identical as Vanguard’s and I could transfer it simply to see what it’s like to make use of Constancy.

As a very long time consumer of Vanguard, I by no means had a purpose to open up a brand new brokerage account… this is likely to be a superb purpose.

[ad_2]