[ad_1]

That is the BJP authorities’s closing Union Finances earlier than the 2024 elections. (Representational)

Union funds on Wednesday will take a look at the federal government’s resolve to remain fiscally prudent as expectations of decrease taxes, wider social safety internet and additional enhance to manufacturing collect steam earlier than nationwide elections.

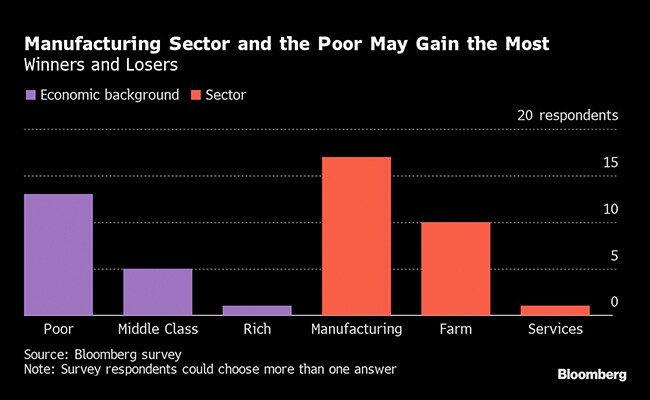

Finance Minister Nirmala Sitharaman could tweak income-tax slabs to supply aid to the nation’s huge center class and improve spend on the poor via applications comparable to rural jobs, whereas ramping up monetary incentives for native manufacturing, in accordance with economists and stories in native media.

Social welfare applications would get “applicable” allocation as “the hole between have and have nots has widened,” stated India Scores & Analysis Pvt. economist Devendra Kumar Pant. Inflation has eroded spending energy and aid in tax “can present the much-needed thrust to the consumption demand.”

Prime Minister Narendra Modi’s closing full-year spending plan earlier than 2024 polls comes amid rising rates of interest and slowing world progress, which might make him desist from outright populism. Economists in a Bloomberg survey see fiscal deficit narrowing to five.9% of gross home product, from 6.4% this 12 months, needing one other 12 months of report borrowing.

Whereas markets might be carefully looking forward to the funds speech at 11 am to see what Asia’s third-biggest economic system has in retailer for buyers, US quick vendor Hindenburg’s scathing report on billionaire Gautam Adani’s conglomerate has additionally put highlight on the nation, and the problem could reverberate within the funds session of parliament.

Listed here are among the measures to look out for within the funds:

Tax Tweaks

Sitharaman’s current feedback on figuring out the “pressures of the center class” have added to hypothesis she would put some cash within the pockets of taxpayers. However there are not any free lunches. “Any tinkering with charges on the decrease earnings brackets might be compensated by rising the cess/surcharge for the higher earnings brackets,” Sure Financial institution economists led by Indranil Pan stated, projecting a 15% rise in tax receipts subsequent 12 months.

She may additionally increase import duties on objects comparable to personal jets, helicopters, high-end digital objects and jewelery to encourage home manufacturing, in accordance with The Financial Instances.

Social Sector

India’s jobless fee jumped to a 16-month excessive of 8.3% final month, underscoring the problem to create jobs for the world’s greatest inhabitants. DBS Group economist Radhika Rao sees the spend on rural job assure topping this 12 months’s allocation of 730 billion rupees ($9 billion), with crop insurance coverage, rural street infrastructure and low-cost housing additionally getting consideration.

India’s world-beating progress masks rising inequality with 21 wealthiest billionaires possessing extra wealth than 700 million Indians, in accordance with Oxfam India. The funds could widen the ambit of small financial savings plans for the aged and the lady baby, stated Soumya Kanti Ghosh, an economist with State Financial institution of India.

Manufacturing

With India positioning itself as a substitute for China within the world provide chain, producers keen to arrange factories within the nation count on extra monetary advantages from the federal government. The funds might even see production-linked incentives getting prolonged to sectors comparable to delivery containers and toys, in accordance with Hindustan Instances.

Methods will be finetuned to supply a push to manufacturing actions and employment era via deepening and widening of output-linked advantages, Sure Financial institution analysts stated.

Finances wishlist for among the different sectors contains:

- Extension of long run capital positive aspects tax to immovable property, unlisted shares

- Compensation to grease retailers for promoting gas under market costs

- Discount in taxes on cryptoassets introduced in final funds

- Minimize in import taxes on gold to 10% to rein in unlawful shipments

- Enhance in protection funds amid border tensions with China

- Greater capital allocation for banks, extra freedom to lift capital

(Aside from the headline, this story has not been edited by NDTV workers and is revealed from a syndicated feed.)

Featured Video Of The Day

Adani Enterprises Shares Rise, Different Group Shares Lengthen Losses On Hindenburg Affect

[ad_2]

Source link