[ad_1]

Zerodha launched two Index Funds – Zerodha Nifty LargeMidcap 250 Index Fund and Zerodha ELSS Tax Saver Nifty LargeMidcap 250 Index Fund. Do you have to make investments?

As for each funds, the underlying Index is Nifty LargeMidcap 250, so I believed to evaluation each funds on this similar article. The schemes are open for subscription from twentieth October 2023 and can shut on third November 2023.

What’s the Nifty LargeMidcap 250 Index?

The Nifty LargeMidcap 250 displays the efficiency of a portfolio of 100 large-cap and 150 mid-cap corporations listed on the NSE, represented by way of the Nifty 100 and the Nifty Midcap 150 index respectively. The mixture weight of large-cap shares and mid-cap shares is 50% every and is reset on a quarterly foundation.

The index has a base date of April 01, 2005, and a base worth of 1000. The Nifty LargeMidcap 250 Index covers roughly 84% of the complete market capitalization, round 87% of the free-float market capitalization, and roughly 69% of the overall liquidity of all traded fairness shares on NSE primarily based on the 6-month common as of September 29, 2023.

Contemplating this facet, I believe it’s a well-diversified Index than the Complete Market Index (Groww Nifty Complete Market Index Fund – Ought to You Make investments?). Primarily as a result of the overall market index is a capitalized weighted index.

Zerodha Nifty LargeMidcap 250 Index Fund – Do you have to make investments?

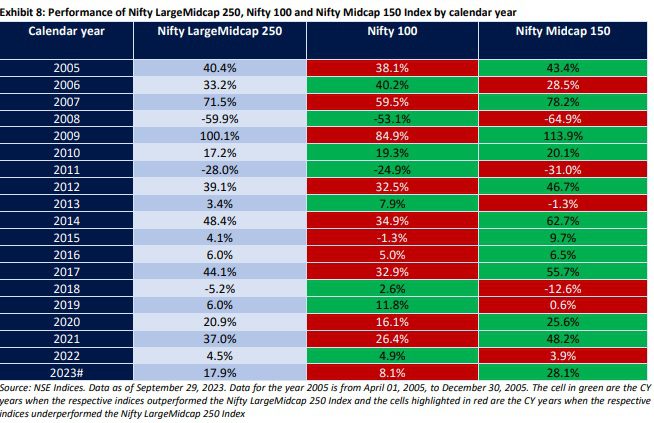

The beneath desk offers you a sign of how the Index carried out in comparison with the Nifty 100 and Nifty Midcap 150 (Souorce NSE Analysis Paper 4th Oct 2023).

You seen that within the majority of the instances, the Nifty LargeMidcap 250 Index carried out nicely at any time when there was a efficiency backup from the Nifty Midcap 150 Idnex (in the event you examine it with the Nifty 100). To validate this level, allow us to examine the Nifty 50 TRI Vs Nifty Midcap 150 TRI and Nifty LargeMidcap 250 TRI indices.

Because the inception date of the Nifty LargeMidcap 250 Index is 1st April 2005, I’ve thought of the identical knowledge for Nifty 50 TRI and Nifty Midcap 150 TRI. This provides us round 4,600+ day by day knowledge factors.

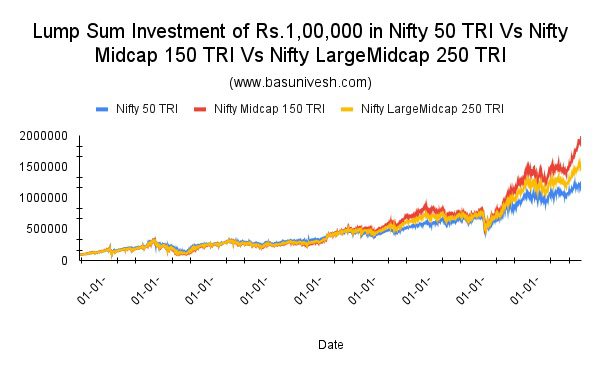

Allow us to go first with what could also be your present values in the event you invested Rs.1,00,000 in every of those indices.

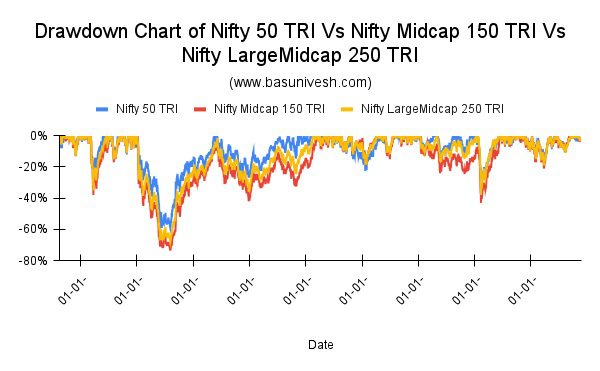

You seen that the efficiency of the Nifty LargeMidcap 250 is between the Nifty 50 TRI and Nifty Midcap 150 TRI indices. The ultimate values of Rs.1,00,000 as of the final buying and selling day have been Rs.11,91,333, Rs.18,79,794, and Rs.15,14,026 for the Nifty 50 TRI Index, Nifty Midcap 150 TRI Index, and Nifty LargeMidcap 250 TRI Index respectively. The efficiency of the Nifty Midcap 150 TRI Index appears to be like engaging however comes with danger. Therefore, allow us to attempt to perceive this by trying on the drawdown chart of all these three indices. Drawdown means how a lot % the Index fell from its earlier peak.

Now you’ll be able to visualize the chance concerned within the Nifty Midcap 150 TRI Index in comparison with Nifty 50 TRI and Nifty LargeMidcap 250 TRI. Allow us to now attempt to perceive the efficiency of all these three indices primarily based on the rolling return idea.

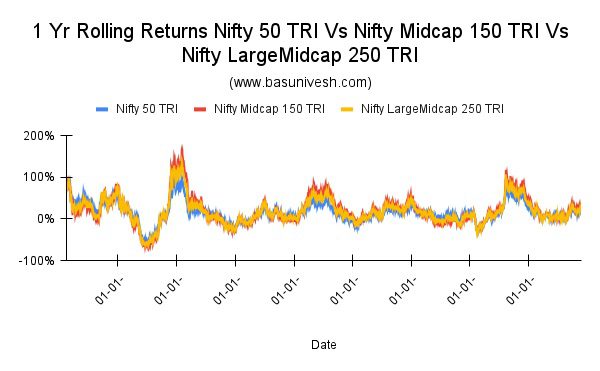

# 1 Yr Rolling Returns Nifty 50 TRI Vs Nifty Midcap 150 TRI Vs Nifty LargeMidcap 250 TRI

You could discover that this won’t give us a transparent image of how all three indices carried out as compared. Nonetheless, the utmost return for Nifty 50 TRI is 100%, the Minimal is -55% and the common is 16%. For the Nifty Midcap 150 Index, the utmost return is 169%, the minimal is -67% and the common is 20%. For Nifty LargeMidcap 250 Index, the utmost return is 138%, the minimal is -62% and the common is eighteen%. This clearly exhibits that the Nifty LargeMidcap 250 Index falls between the Nifty 50 and Nifty Midcap 150 Index.

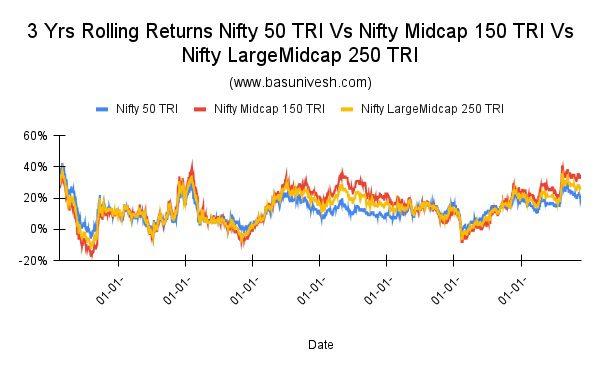

# 3 Yrs Rolling Returns Nifty 50 TRI Vs Nifty Midcap 150 TRI Vs Nifty LargeMidcap 250 TRI

From hereon you’ll be able to discover that at any time when the Nifty Midcap 150 Index carried out higher than the Nifty 50 Index, then the Nifty LargeMidcap 250 additionally outperformed the Nifty 50 Index.

The utmost return for Nifty 50 TRI is 42%, the Minimal is -6% and the common is 12%. For the Nifty Midcap 150 Index, the utmost return is 41%, the minimal is -17% and the common is 15%. For the Nifty LargeMidcap 250 Index, the utmost return is 38%, the minimal is -12%, and the common is 14%. This clearly exhibits that the Nifty LargeMidcap 250 Index falls between the Nifty 50 and Nifty Midcap 150 Index.

# 5 Yrs Rolling Returns Nifty 50 TRI Vs Nifty Midcap 150 TRI Vs Nifty LargeMidcap 250 TRI

Right here additionally, you’ll be able to clearly seen the outperformance motive of the Nifty LargeMidcap 250 Index Vs the Nifty 50 Index.

The utmost return for Nifty 50 TRI is 24%, the Minimal is -1% and the common is 12%. For the Nifty Midcap 150 Index, the utmost return is 29%, the minimal is -2% and the common is 14%. For the Nifty LargeMidcap 250 Index, the utmost return is 25%, the minimal is -2%, and the common is 13%. This clearly exhibits that the Nifty LargeMidcap 250 Index falls between the Nifty 50 and Nifty Midcap 150 Index.

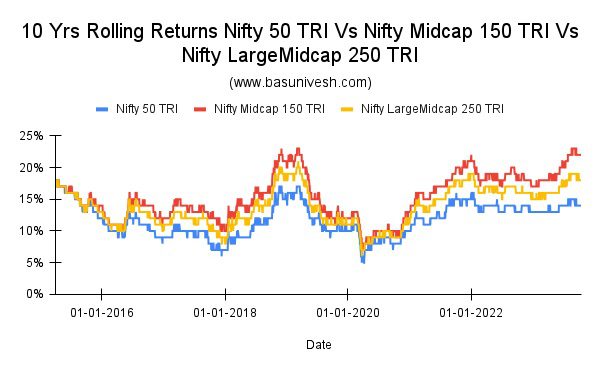

# 10 Yrs Rolling Returns Nifty 50 TRI Vs Nifty Midcap 150 TRI Vs Nifty LargeMidcap 250 TRI

The ten-year rolling returns offers you an increasing number of readability than the sooner rolling returns. Nifty LargeMidcap 250 carried out fantastically when the efficiency of the Nifty Midcap 150 Index jumped up and carried out nicely.

The utmost return for Nifty 50 TRI is eighteen%, the Minimal is 5% and the common is 12%. For the Nifty Midcap 150 Index, the utmost return is 23%, the minimal is 7% and the common is 15%. For the Nifty LargeMidcap 250 Index, the utmost return is 21%, the minimal is 6%, and the common is 14%.

If you happen to take a look at the returns primarily based on calendar years and the way the unfold is, then the beneath chart from the NSE analysis paper will give readability.

Since 2005, the Nifty 100 Index has delivered larger than 30% annual returns in 7 calendar years and the Nifty LargeMidcap 250 Index outperformed the Nifty 100 Index in 6 out of those 7 calendar years (outperformed in 2005, 2007, 2009, 2012, 2014, and 2017). The Nifty 100 Index had unfavorable returns in 3 years (2008, 2011, 2015), and the Nifty LargeMidcap 250 Index has underperformed the Nifty 100 Index in 2 out of those 3 years (2008, 2011). The one exception was in 2015, when the Nifty 100 Index returned -1.3%, however the Nifty LargeMidcap 250 Index outperformed and returned 4.1% in that yr as a result of publicity to midcap shares by way of the Nifty Midcap 150 Index which delivered 9.7%.

Conclusion –

- Contemplating the above knowledge from 2005 to 2023, we are able to conclude that because of its midcap publicity, the Nifty LargeMidcap 250 Index outperformed the Nifty 50 Index. This outperformance is just not freed from price. It comes with danger additionally (as a result of 50% inclusion of the Nifty Midcap 150 Index).

- Nonetheless, those that are searching for a single fund than two funds (Nifty 100/Nifty 50 plus Nifty Midcap) can search for this fund. However watch out for the chance and volatility of the Index.

- As it’s a new fund, we’re not sure of the expense ratio they MANAGE (by no means search for the present mouthwatering low expense ratio, they’ve all rights to vary as and after they really feel NEED) persistently sooner or later and in addition the fund efficiency is topic to the monitoring error.

- However total this fund matches nicely for individuals who desire a easy resolution of getting publicity to Nifty 100 + Nifty Midcap 150 Index.

- Relating to the Zerodha ELSS Tax Saver Nifty LargeMidcap 250 Index Fund, I strongly recommend you keep away. Primarily as a result of these days filling the Sec.80C profit is much simpler. Many will fill this with their EPF, Time period Life Insurance coverage Premium, and PPF contribution itself. Therefore, you’ll be able to ignore the Zerodha ELSS Tax Saver Nifty LargeMidcap 250 Index Fund funding.

[ad_2]